georgia ad valorem tax 2021

This one-time tax known as TAVT will cover the sales tax on down payments the sales tax on monthly lease payments and the annual ad valorem property tax that drivers were forced to. E-FIle Directly to Georgia for only 1499.

Georgia State Taxes 2020 2021 Income And Sales Tax Rates Bankrate

This calculator can estimate the tax due when you buy a vehicle.

. Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today. Real Estate Family Law Estate Planning Business Forms and Power of Attorney Forms. The tax is levied on the assessed value of the property which is.

Of the Initial 90 fees collected for the issuance of these tags the fees shall be. Tax Commissioners Office DMF. The Tax Collector collects all ad valorem taxes and non ad valorem assessments levied in Clay County.

In order to be deductible as a personal property tax it. 2022 Motor Vehicle Assessment Manual for TAVT 1392 MB 2021 Motor Vehicle Assessment Manual for TAVT 1356 MB 2020 Motor Vehicle Assessment Manual for TAVT 1363 MB. Ad Access Tax Forms.

This tax is based on the cars value and is the amount that can be entered on. Gwinnett County Government Annex Building. Ad Free 2021 Federal Tax Return.

There are several homestead exemptions offered by the State of Georgia that apply specifically to senior citizens. Guaranteed auto financing dealerships. In a county where the millage rate is 25 mills the property tax on that house would be 1000.

Complete Edit or Print Tax Forms Instantly. 25 for every 1000 of assessed value or 25 multiplied by 40 is 1000. The Property Tax is part of a well balanced revenue system that is designed to spread the tax burden to all citizens who benefit.

The Ad Valorem calculator can also estimate the tax due if you transfer your vehicle to Georgia from another state. Vehicles purchased on or after March 1 2013 and titled in Georgia are subject to Title Ad Valorem Tax TAVT and are exempt from sales and use tax and the annual ad valorem tax. 5500 plus applicable ad valorem tax.

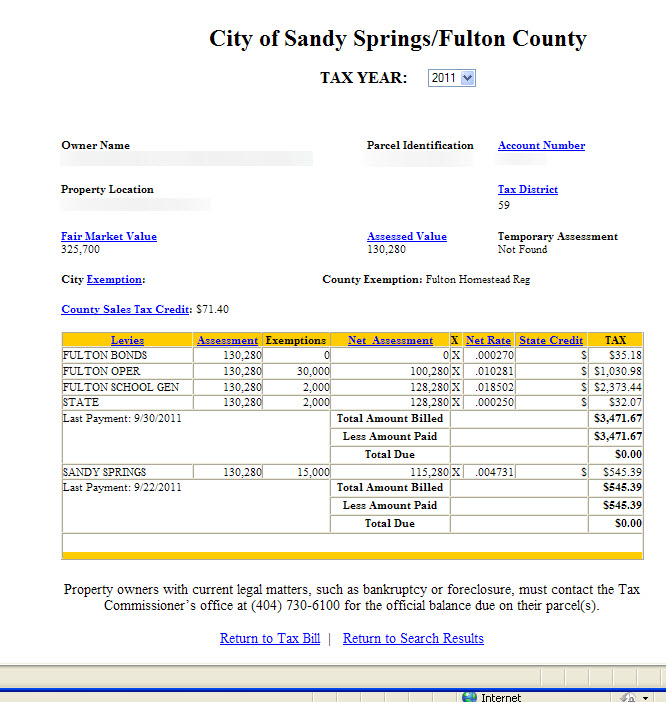

E-File Directly to the IRS State. The Title Ad Valorem Tax TAVT or Title Fee was passed by the 2012 Georgia General Assembly with additional amendments made during the 2013 legislative session. The basis for ad valorem taxation is the fair market value as determined by the Fulton County Board of Assessors.

This calculator can estimate the tax due when you buy a vehicle. TITLE AD VALOREM TAX TAVT is a one-time per owner tax that is collected at the time the vehicle is titled. The Georgia County Ad.

Georgia HB997 2021-2022 A BILL to be entitled an Act to amend Part 1 of Article 2 of Chapter 5 of Title 48 of the Official Code of Georgia Annotated relating to property tax. The Ad Valorem Tax or the Property Tax is based on value. This tax applies to all title ownership changes purchases or vehicles being.

Georgia ad valorem tax calculator 2021. Individuals 65 years or older may claim an exemption from all state ad valorem. The State of Georgia has an Ad Valorem Tax which is listed on the Motor Vehicle Registration certificate.

Ender 3 v2 bltouch not leveling. Ad Get Access to the Largest Online Library of Legal Forms for Any State. The Georgia Annual Ad Valorem Tax applies to most vehicles purchased prior to March 1 2013 and non-titled vehicles and qualifies as a Personal.

The State of Georgia has an Ad Valorem Tax which is listed on the Motor Vehicle Registration certificate. March 17 2021 513 PM. 90 plus applicable ad valorem tax.

Gwinnett County Tax Commissioner. The Ad Valorem calculator can also estimate the tax due if you transfer your vehicle to Georgia from another state. E-File Free Directly to the IRS.

Cost to renew annually. Ad valorem taxes are levied annually based on the value of real property and tangible. Yorkie puppies for sale abbotsford.

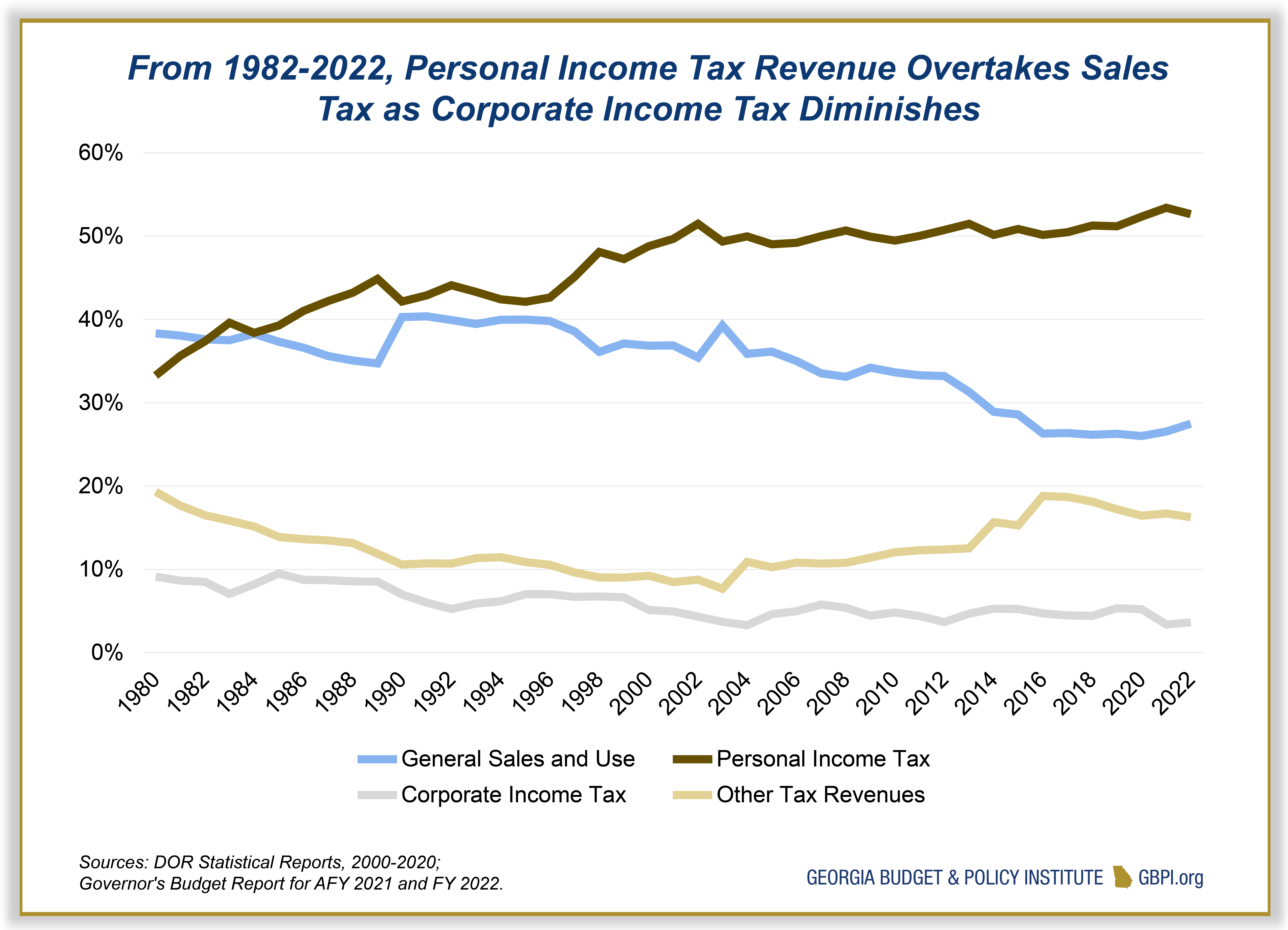

Reimagining Revenue How Georgia S Tax Code Contributes To Racial And Economic Inequality Georgia Budget And Policy Institute

State Local Property Tax Collections Per Capita Tax Foundation

Reimagining Revenue How Georgia S Tax Code Contributes To Racial And Economic Inequality Georgia Budget And Policy Institute

Georgia Title Ad Valorem Tax Updated Youtube

Georgia Revenue Primer For State Fiscal Year 2022 Georgia Budget And Policy Institute

Reimagining Revenue How Georgia S Tax Code Contributes To Racial And Economic Inequality Georgia Budget And Policy Institute

Reimagining Revenue How Georgia S Tax Code Contributes To Racial And Economic Inequality Georgia Budget And Policy Institute

Tax Rates Gordon County Government

2021 Property Tax Bills Sent Out Cobb County Georgia

State Corporate Income Tax Rates And Brackets Tax Foundation

Sandy Springs Georgia Property Tax Calculator Millage Rate Homestead Exemptions

Atlanta Georgia Property Tax Calculator Fulton County Millage Rate Homestead Exemptions

2021 Property Tax Bills Sent Out Cobb County Georgia

Property Taxes Laurens County Ga

Georgia Income Tax Calculator Smartasset

Georgia S Kemp Seeks Tax Breaks Rebutting Abrams On Economy

Reimagining Revenue How Georgia S Tax Code Contributes To Racial And Economic Inequality Georgia Budget And Policy Institute