vermont income tax rate 2020

1210 cents per gallon of regular gasoline 28 cents per gallon of diesel. Vermont also has a 600 percent to 85 percent corporate income tax rate.

Freedom In The 50 States 2021 Vermont Overall Freedom Cato Institute

186 average effective rate.

. Vermont Tax Brackets for Tax Year 2020. We have begun mailing 2021 Senior Freeze Property Tax Reimbursement checks to applicants who filed before May 1 2022. If your New Jersey taxable income is less than 100000 you can use the New Jersey Tax Table or New Jersey Rate Schedules.

Vermonts income tax brackets were last changed two years prior to 2020 for tax year 2018 and the tax rates were previously changed in 2017. There are -919 days left until Tax Day on April 16th 2020. The Township tax rate had no increase in 2021 2020 and 2019 after having been lowered.

Any income over 204000 and 248350 for. This means that these brackets applied to all income earned in 2019 and the tax return that uses these tax rates was due in April 2020. When using the tax table use the correct.

Vermont state income tax rate table for the 2020 - 2021 filing season has four income tax brackets with VT tax rates of 335 66. RateSched-2020pdf 11722 KB File Format. Tax amount varies by county.

Monday February 8 2021 - 1200. Vermont Income Tax Rate 2020 - 2021. For fourth year in a row Piscataway Township has a 128 percent lower municipal tax rate.

As you can see your Vermont income is taxed at different rates within the given tax brackets. Compare your take home after tax and estimate. Vermonts rate schedules are designed to maintain at least 15 years of funding if no additional taxes are paid.

Tax Year 2020 Personal Income Tax - VT Rate Schedules. Vermonts tax brackets are indexed for inflation. 2020 Vermont Tax Tables with 2022 Federal income tax rates medicare rate FICA and supporting tax and withholdings calculator.

Vermont has a graduated individual income tax with rates ranging from 335 percent to 875 percent. The IRS will start accepting eFiled tax returns in January 2020 - you can start your online tax return today for free with TurboTax. The median property tax in New Jersey is 657900 per year for a home worth the median value of 34830000.

Vermonts income tax brackets were last changed two. We will mail checks to qualified applicants as. 189 of home value.

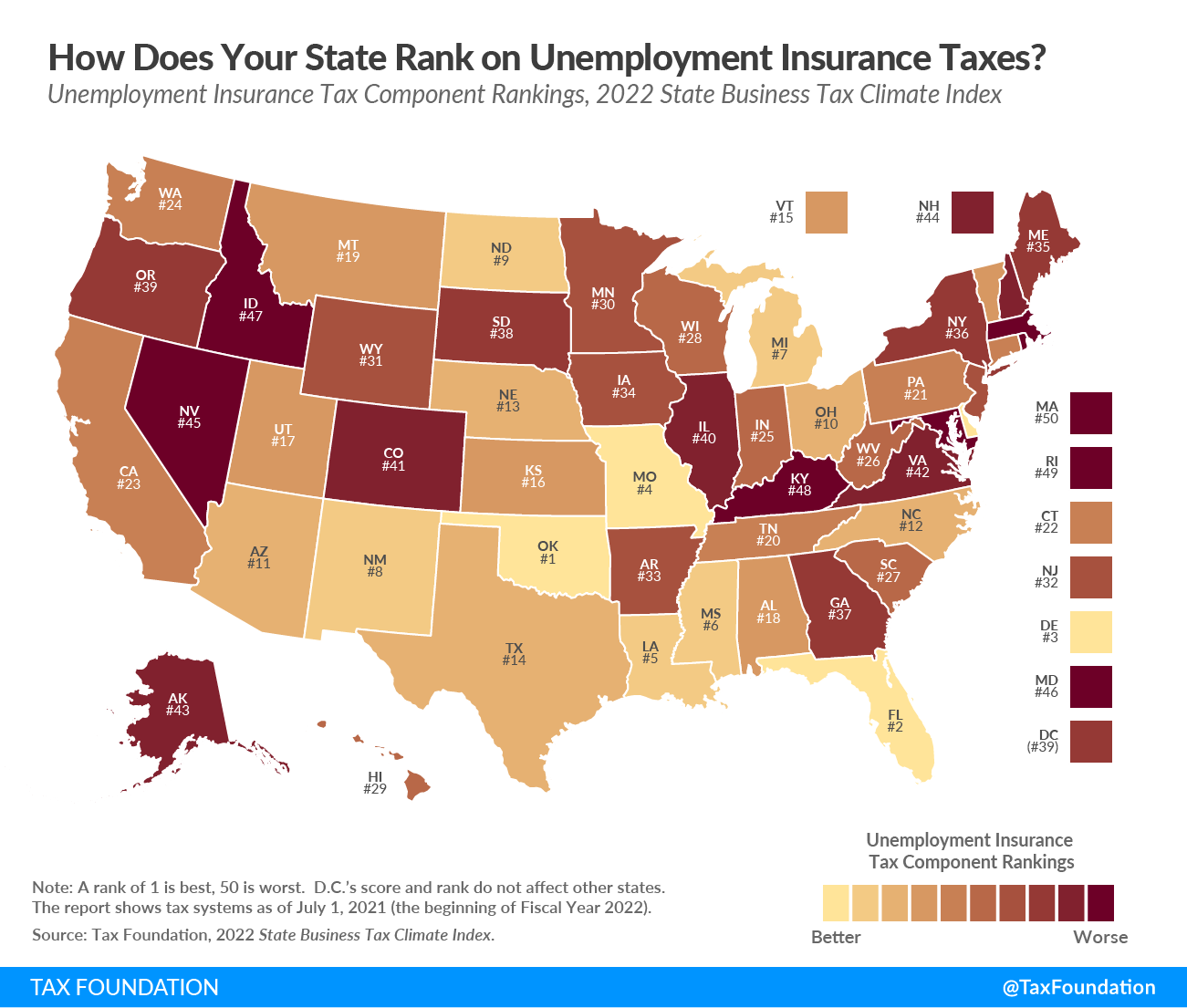

What Is My State Unemployment Tax Rate 2022 Suta Rates By State

State Income Tax Rates Highest Lowest 2021 Changes

Utah Income Tax Rate And Brackets 2019

Vt Dept Of Taxes Vtdepttaxes Twitter

State Taxes On Capital Gains Center On Budget And Policy Priorities

Vermont Tax Rates Rankings Vermont State Taxes Tax Foundation

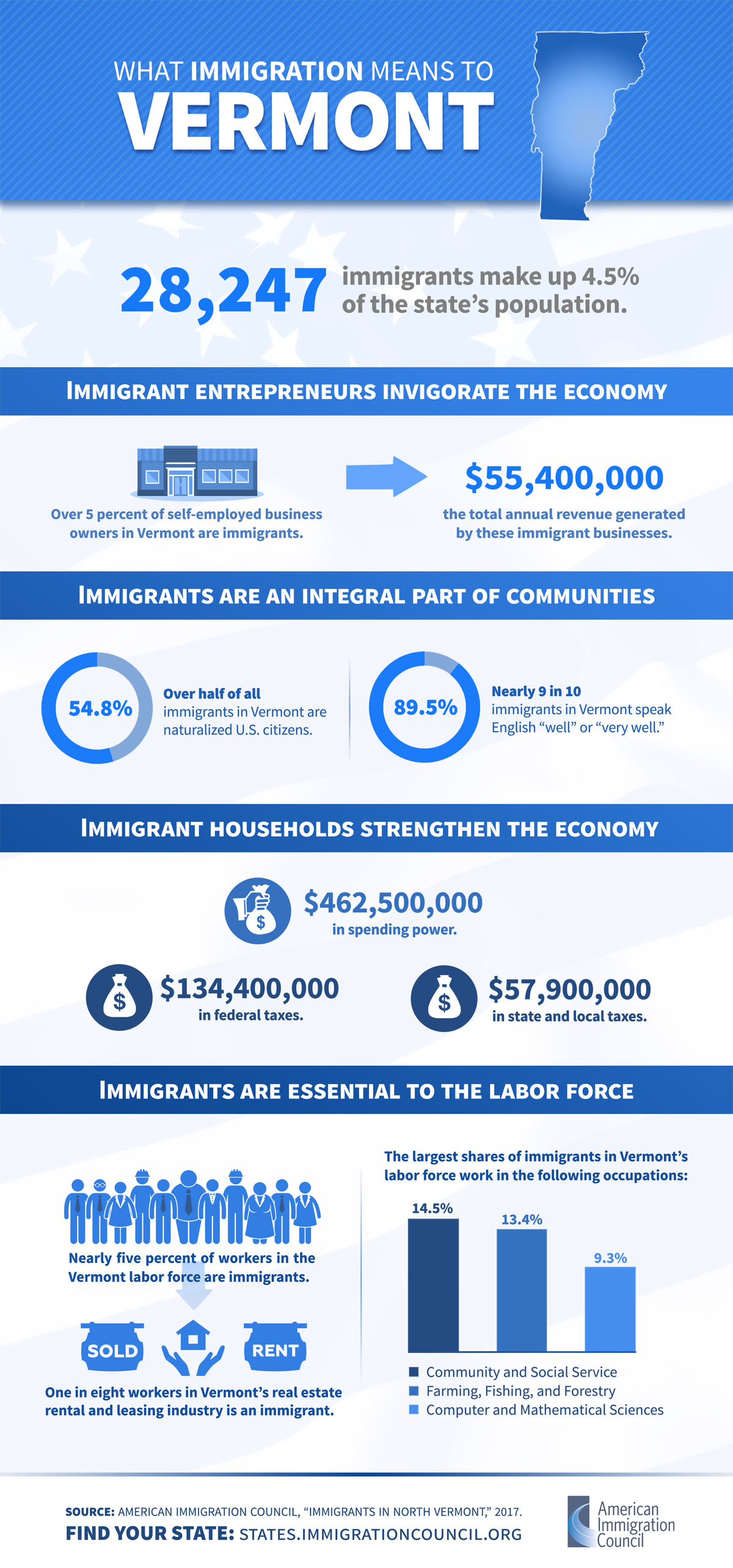

Immigrants In Vermont American Immigration Council

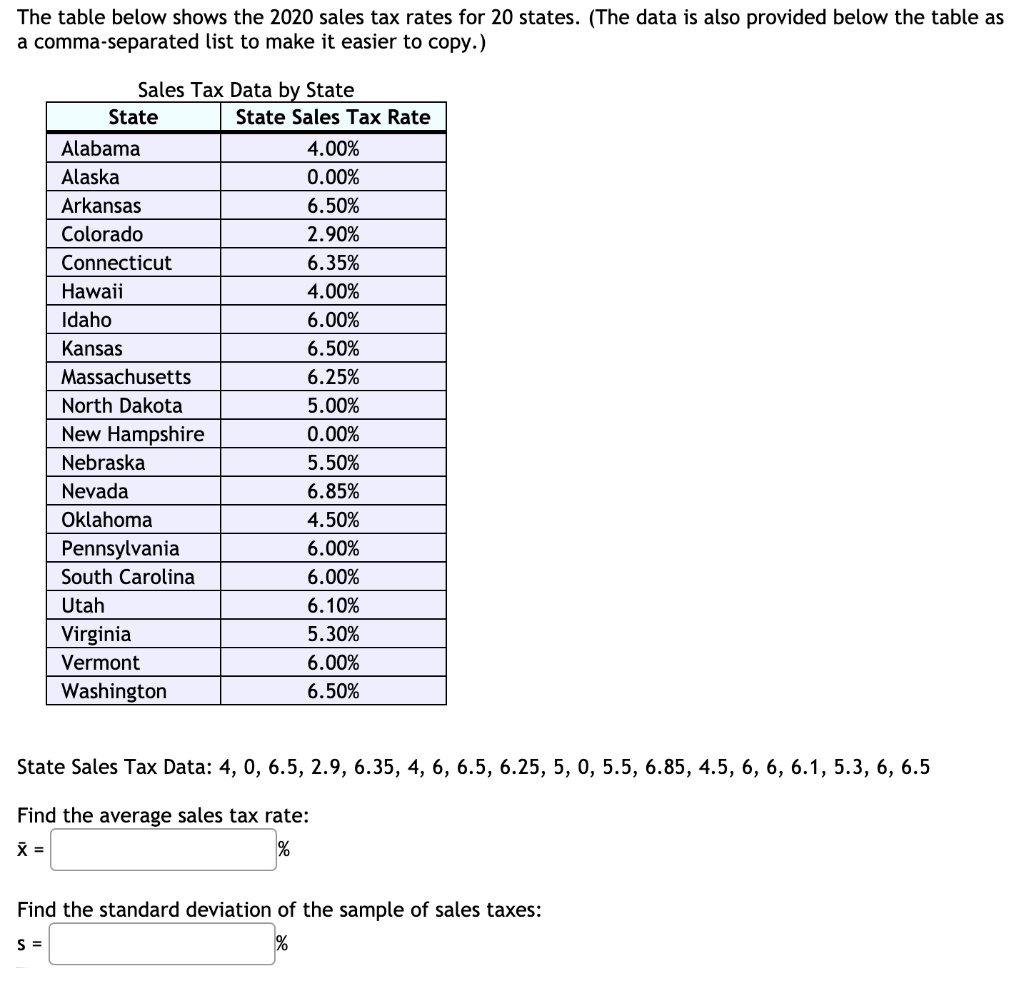

Solved Could You Help Me Figure Out What The Average Sales Chegg Com

Fy 2020 Tax Structure Explained Winners And Losers Vermont Business Magazine

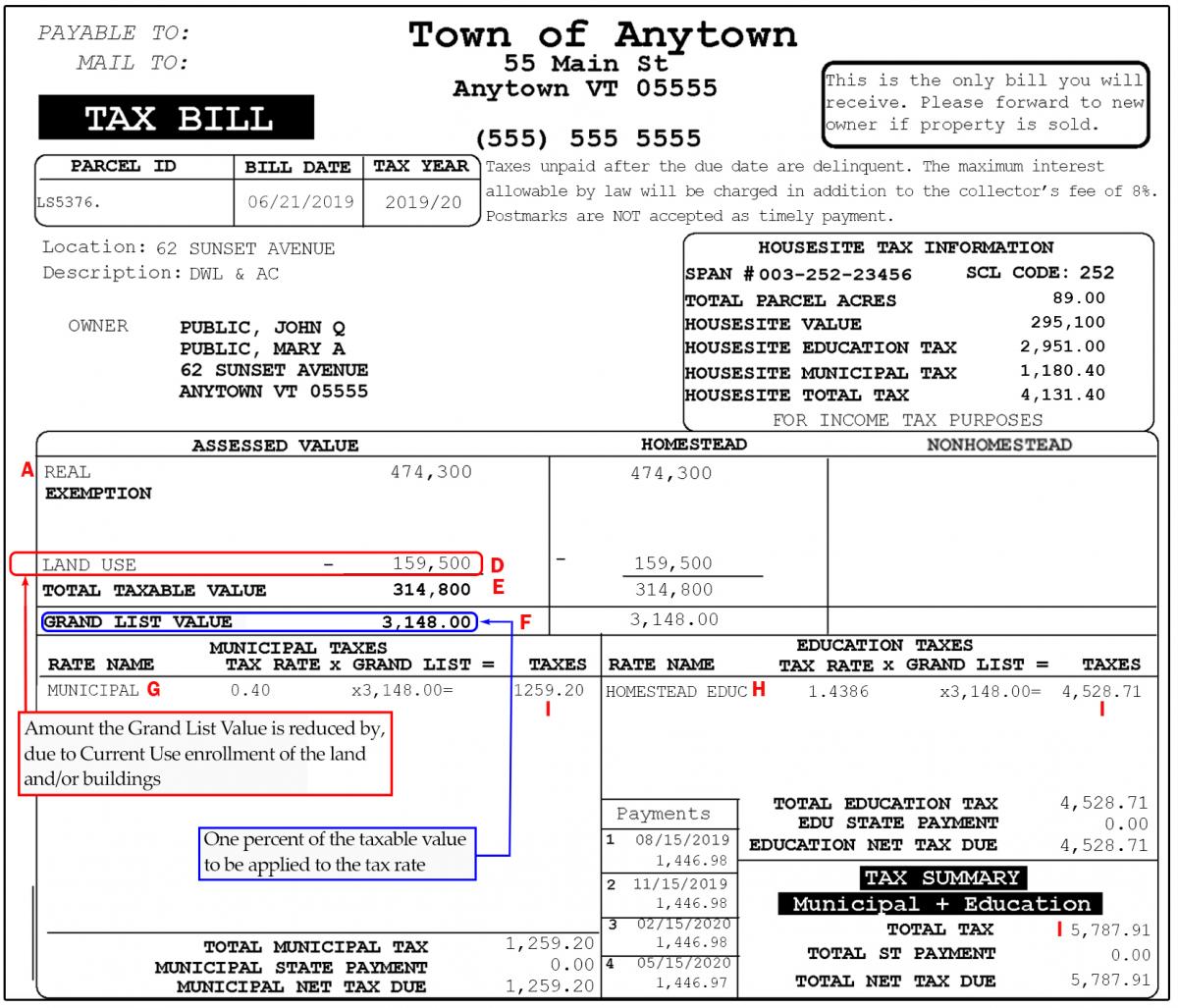

Current Use And Your Property Tax Bill Department Of Taxes

How Do Marijuana Taxes Work Tax Policy Center

What Students Need To Know About Filing Taxes This Year Money

Vermont Tax Rates Rankings Vermont State Taxes Tax Foundation

Vermont State House Covid 19 Response Legislation S 344 4 20 2020 Youtube

Amazon Has Record Breaking Profits In 2020 Avoids 2 3 Billion In Federal Income Taxes Itep

Taxation Of Social Security Benefits Mn House Research

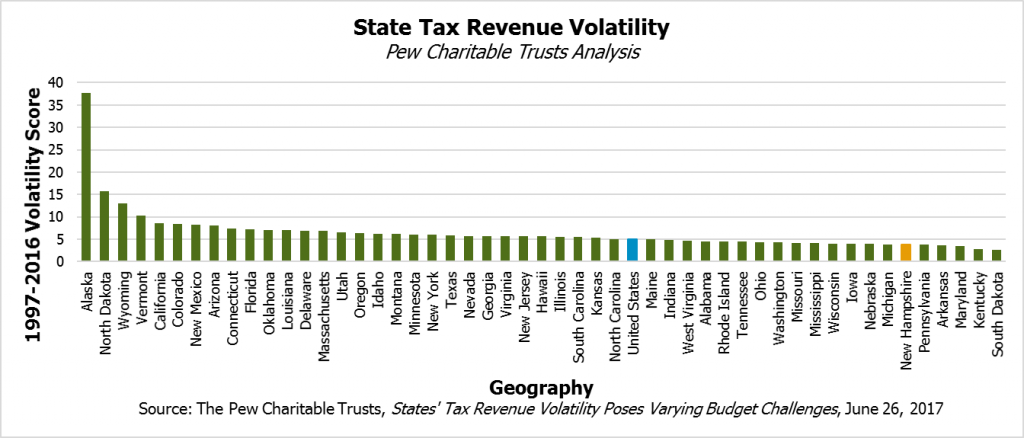

State S Diverse Tax Base Stabilizes Revenue But Business Tax Changes May Increase Volatility New Hampshire Fiscal Policy Institute

New Report Vermont S Tax System Is Among The Least Regressive Public Assets Institute